We work to advance an anti-racist, inclusive child allowance—or a guaranteed minimum income—for families with children.

A child allowance can reduce poverty, improve child well-being, and help families afford the essentials that children need to thrive. It can also serve as an important tool to promote racial equity: because of the way systemic racism has shaped policies, Black, Latinx, Indigenous, and immigrant children in the U.S. have significantly higher poverty rates than White children. We believe a child allowance that provides regular, meaningful assistance to families can advance racial and economic justice as well as serve as a foundation for a more equitable and inclusive social support system.

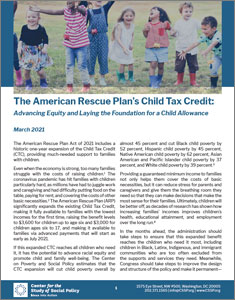

In 2021, Congress expanded the Child Tax Credit (CTC) through the American Rescue Plan Act, modeling a version of what a child allowance can look like in the U.S. Under the expansion, CTC benefits were increased, payments were delivered monthly, and families with lower incomes became eligible for the full benefit for the first time ever. The improved CTC was a lifeline for families, lifting 5.3 million people above the poverty line in 2021, including 2.9 million children. Importantly, given the long history of the CTC and other government supports excluding and underserving Black and Latinx families, the 2021 CTC had a profound impact on families of color. This temporary expansion was a step toward transforming the CTC to function more like a child allowance, and thus we have done significant related research on families’ experiences with the CTC. Our commitment to the development of an anti-racist, inclusive child allowance for families continues to define our engagement in historical research, collaboration with families, the generation of new ideas, and advocating for a regularly delivered, meaningful cash benefit for families with children.

Additional Resources

We take a collective approach to advancing a child allowance that promotes economic and racial justice for all families. Our work is grounded in deep historical research that examines the ways in which policies and decisions have been built over time and how they continue to influence decisions and impact families in policy today. In addition to grounding our work in historical research, we center the experiences and needs of families through a combination of strategies including long-term collaboration and qualitative interviews and surveys. We believe that developing meaningful solutions can only be achieved if our policy work is driven by what families determine they need in ways that they determine work best.

Driven by both deep historical research and families’ needs, we advance a child allowance through new idea generation and collaborative action for change. An important element of this work is our work co-chairing, the ABC Coalition. This coalition is a collaborative partnership with diverse organizations to advance a child allowance.

- Listen to Families and Keep It Simple: Expand the CTC Now

- New Census Data Confirms the Powerful Impact of the Child Tax Credit

- Insights From Families: Caregivers Describe How Monthly CTC Payments Help Them Stay Afloat

- Why We Need a Child Allowance: Lessons from the Child Tax Credit

- New Data Confirms Cash Assistance Helps Lift Families from Poverty

- One Path to a Child Allowance: Reforming the Child Tax Credit

Past Events

Beyond Temporary Relief for Families: Lessons from ARPA’s Investments in Child Care & the Child Tax Credit

November 2022 Watch the Center for the Study of Social Policy and a panel of parents and stakeholders discuss the impact of temporary investments made in families last year by the American Rescue Plan Act (ARPA) and to hear discussion around what’s needed now: permanent investments in families. The event will synthesized CSSP’s recent research with 45 Black and Latinx families in Michigan, Mississippi, and North Carolina on the impact of ARPA’s short-term investments in the Child Tax Credit (CTC) and child care.

Ensuring Families Receive the Child Tax Credit

July 2021

This webinar, from the Automatic Benefit for Children (ABC) Coalition, shared innovative outreach strategies to raise awareness about the child tax credit and how families can sign up.

As an extension of our work to advance an anti-racist child allowance, CSSP co-chairs the Automatic Benefit for Children coalition with the Children’s Defense Fund. In this work, we engage with partner organizations to advocate and strengthen the case for establishing a child allowance in the U.S.

As an extension of our work to advance an anti-racist child allowance, CSSP co-chairs the Automatic Benefit for Children coalition with the Children’s Defense Fund. In this work, we engage with partner organizations to advocate and strengthen the case for establishing a child allowance in the U.S.