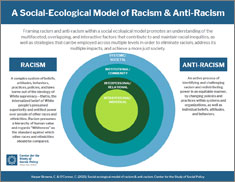

This handout frames racism and anti-racism within a social ecological model in order to promote an understanding of the multifaceted, overlapping, and interactive factors that contribute to and maintain racial inequities, as well as strategies that can be employed across multiple levels in order to eliminate racism, address its multiple impacts, and achieve a more just society.

(2 pp)